Our Story

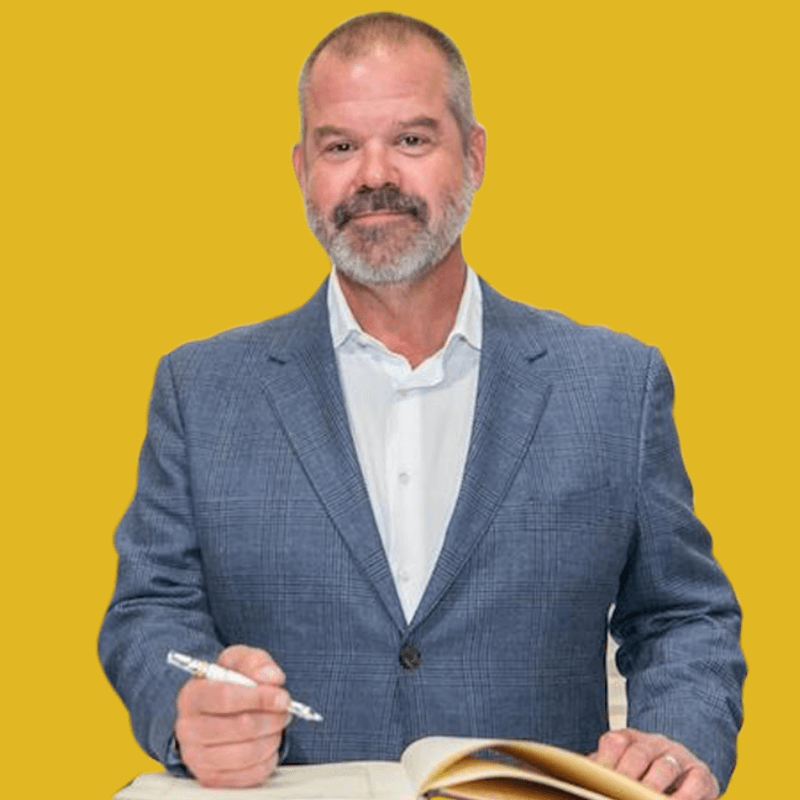

Kevin T. Carter is the Founder & Chief Investment Officer of EMQQ Global. While he principally considers himself an active “value” investor, he has collaborated with Princeton economist and author of A Random Walk Down Wall Street, Dr. Burton G. Malkiel, for more than 20 years. Their work together began in 1999 when Carter founded eInvesting, a pioneer firm in fractional share brokerage acquired by ETRADE in 2000. In 2002 they co-founded Active Index Advisors, a pioneer in “direct indexing” acquired by Natixis Asset Management in 2005. In 2006, their efforts turned to China and Emerging Markets as they launched several China-focused ETFs on the NYSE with Guggenheim Partners. Mr. Carter founded EMQQ Global in 2014 and launched The Emerging Markets Internet ETF on the NYSE on November 12, 2014.

Kevin T. Carter is the Founder & Chief Investment Officer of EMQQ Global, including the EMQQ, FMQQ, and INQQ ETFs. While he considers himself an active “value” investor first and foremost, he has collaborated with Princeton economist and indexing legend, Dr. Burton Malkiel, for more than 20 years. Their work together began in 1999 with the development of eInvesting, a pioneer firm in fractional share brokerage that was acquired by ETRADE in 2000. In 2002 they founded Active Index Advisors, a pioneer in so-called “direct indexing” that was acquired by Natixis Asset Management in 2005. In 2006, their efforts turned to China and Emerging Markets with Dr. Malkiel’s publishing of “Investment Strategies to Exploit Economic Growth in China” and the subsequent book From Wall Street to the Great Wall. Working with Guggenheim Partners, they launched several China focused ETFs on the NYSE.

Kevin launched the flagship EMQQ ETF in 2014 after noticing how the smartphone was changing his personal consumption habits. He now lives in Lafayette, California, with his wife and three children.

Kevin T. Carter

Kevin T. Carter is the Founder & Chief Investment Officer of EMQQ Global, including the EMQQ, FMQQ, and INQQ ETFs. While he considers himself an active “value” investor first and foremost, he has collaborated with Princeton economist and author of A Random Walk Down Wall Street, Dr. Burton Malkiel, for more than 20 years.

Mr. Parker is the President of EMQQ Global. Previously, Mr. Parker worked at Progress Investment Management Co., the San Francisco based firm focused on minority and womenowned emerging managers. He previously worked at AlphaShares, an investment firm founded by Mr. Carter and Dr. Malkiel, offering Emerging Markets and China focused ETFs in partnership with Guggenheim Investments. Mr. Parker holds a B.A. in Economics from the University of California, Santa Barbara.

Ms. Benson is the Director of Business Development at EMQQ Global. Previously, Kira led business development at MARS SalesFocus Solutions, a provider of distribution intelligence for the asset management industry. Kira spent 7 years in London working in relationship management at both BlueBay Asset Management and BlackRock. Preceding her move to London Kira worked in securities lending at BlackRock’s San Francisco office. Kira began her career at Morgan Stanley’s Graystone Consulting after graduating from the University of California, Santa Barbara.

Erica Allaby is the Chief Marketing Officer at EMQQ Global. Over the the last decade, Erica developed the art of investor-centric storytelling with a focus on disruptive technology and the companies on the forefront of innovation while overseeing ROBO Global’s content & product marketing until its successful acquisition by VettaFi in 2023. Erica graduated from High Point University as a Presidential Scholar with a B.A. in Communications.

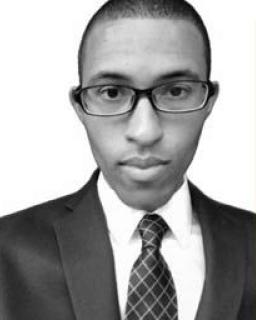

Mr. Bailey is the Director of Research for EMQQ Global. Previously, Akeem worked at Rondure Global Advisors, where he helped oversee research and due diligence on emerging market equities and at Arisaig Partners, a Singaporebased hedge fund focused exclusively on consumer and internet companies in emerging markets. Akeem began his career living and working in India as a strategy consultant for the Mahindra Group. Akeem holds a B.A. in International Relations from the University of Pennsylvania.

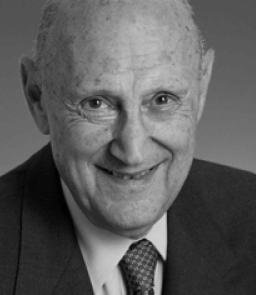

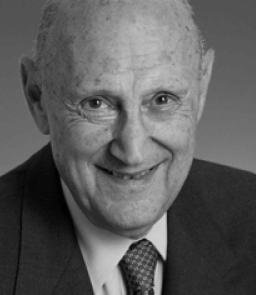

Dr. Burton G. Malkiel has served as an advisor to the EMQQ Global Index Committee since inception. Dr. Malkiel is a longtime Professor of Economics at Princeton University and is best known for his seminal book A Random Walk Down Wall Street. In 1999 he served as an advisor to eInvesting, a fractional share brokerage acquired by ETRADE in 2000. In 2002 he was a co-Founder and CIO of Active Index Advisors. He is widely considered one of the pioneers of index investing and ETFs. He has served on the Board of Directors of Vanguard, as Dean of the Yale School of Management and as Chairman of the Princeton University Economics Department. Dr. Malkiel holds BA and MBA from Harvard and a PhD from Princeton University.

Dr. Zhang is an Advisor to the EMQQ Global Index Committee. She is the CEO of New York based Purview Investments, a firm specializing in active ETF managed solutions and ETF innovation. Her career spans from quantitative analysis at Baring Asset Management, multi-asset portfolio management at Blackrock and MFS, to leading the investment team at Windhaven. She is a recipient of Top Women in Asset Management 2015 by Money Management Executive and a co-founder of Women in ETFs. She holds a B.A. from University of Regina, Canada, M.S. and Ph.D. in Finance from University of Massachusetts at Amherst.

Mr. Venuto is an Advisor to the EMQQ Global Index Committee. He is an ETF industry veteran with two decades of experience in the design and implementation of ETF-based investment strategies. Michael is currently Co-Founder and Chief Investment Officer of Toroso Investments, LLC. Michael is also a Director of Tidal ETF Services, which helps investors launch and grow ETFs. Previously, he was Head of Investments at Global X Funds. Before that, he was Senior Vice President and Portfolio Manger at Horizon Kinetics.

Mr. Kang is an Advisor to the EMQQ Global Index Committee. He has the experience of over 25 NYSE listed ETF launches and was previously the Chief Investment Officer of EGShares and Portfolio Manager of the Columbia Emerging Markets Consumer ETF (NYSE: ECON). Over his 20 years of buy-side experience, Richard has had senior roles at a hedge fund, fund-of-hedge fund, investment counseling firm, index provider and ETF issuer/managers. He sits on FTSE’s Country Classification Indexing Committee as well as the editorial board of Institutional Investors’ The Journal of Index Investing, the only academic journal for the indexing and ETF industry.

EMQQ Global Team

Our team is devoted to helping investors capture today’s innovation occurring across emerging and frontier markets.

Kyle Parker

President

Kira Benson

Director of Business Development

Erica Allaby

Chief Marketing Officer

Akeem Bailey

Director of Research

Dr. Burton Malkiel

EMQQ Global Advisor

Linda H. Zhang, Ph.D

EMQQ Global Advisor

Michael J. Venuto

EMQQ Global Advisor

Richard Kang

EMQQ Global Advisor

Frequently Asked Questions

What is EMQQ Global?

EMQQ Global is a San Francisco-based investment management and research firm focused on providing investors access to the fast-growing Emerging and Frontier Markets technology sector. The companies we invest in represent the global expansion of smartphone-empowered consumers in Emerging and Frontier Markets who are going online for the first time.

Why Invest in Emerging Markets Internet & Ecommerce Companies?

A growing middle class—Global demographic and technological advancements are expanding internet access and increasing affluence and consumerism in the developing world. According to 2023 data from World Economics, emerging and frontier markets are home to over 5.3 billion people, with a median age of 34 in emerging markets and 28 in frontier markets.

Rapid smartphone adoption rates driving online consumption – “The Leapfrog Effect.” The plunging costs of smartphones and wireless broadband are providing unprecedentedly large swaths of the population in developing countries with access to the internet for the first time, enabling revolutions not just in consumption patterns but also in digital payments, communication, healthcare, education, entertainment, delivery, and more.1

Diversification. EMQQ Global targets exposure to a global theme with over 130 emerging market tech companies to prevent any single company from exercising an outsize influence.

1 National Payments Corporation of India (NPCI), Sept 2024, IMF, The Global Economy Report 2024, Newzoo Data 2024

When did the EMQQ ETF Launch?

Our flagship ETF, EMQQ, launched in November 2014 after EMQQ Global Founder, Kevin T. Carter noticed his own consumption patterns changing via the smartphone.

How are the EMQQ, FMQQ, & INQQ Indexes Constructed?

Our indexes are constructed using the same methodology, varying only in their country exposure.

The EMQQ Global Methodology:

All companies with >50% of revenue from Internet and/or Ecommerce in Emerging and Frontier Markets

Must have a free-float adjusted market capitalization of USD $1 Billion or greater for initial inclusion in the Index. A free-float adjusted USD $800 Million minimum is required for ongoing Index inclusion.

Liquidity screen $1.0mm average daily turnover

Rebalanced and reconstituted semi-annually in June and December

Fast track IPO inclusion after 3 trading days if market cap >$10 Billion

Index Committee discretion (by majority vote for special inclusions and removals)

Market Cap weighted with 8% max weight per security at rebalance

What’s The Difference Between the EMQQ, FMQQ, & INQQ ETFs?

All three products have the same thesis: to provide investors with targeted exposure to the rapidly growing Emerging Markets Technology Sector, varying only by country exposure.

EMQQ ETF: All Emerging and Frontier Internet and Ecommerce companies that satisfy the index rules

FMQQ ETF: All Emerging and Frontier Internet and Ecommerce companies that satisfy the index rules, excluding China

INQQ ETF: Exclusively Indian Internet and Ecommerce companies that satisfy the index rules

How Do I Buy the EMQQ, FMQQ, & INQQ ETFs?

Each strategy is available as an NYSE-listed ETF. Talk to your financial advisor about how investing in the EMQQ Global ETFs can help you meet your financial objectives, or purchase directly through your online brokerage account with access to the New York Stock Exchange listings.

Receive regular updates and notifications on EMQQ Global’s latest research

Investing in global innovation starts with understanding it. Stay updated with news and articles. Enter your email below to subscribe to our latest updates.

Disclosures

Carefully consider the Fund’s investment objectives, risk factors, charges and expenses before investing. This and additional information can be found in the Fund’s prospectus, which may be obtained by visiting www.emqqglobaletfs.com. Read the prospectus carefully before investing.

Market price returns are based on the official closing price of an ETF share or, if the official closing price isn’t available, the midpoint between the national best bid and national best offer (“NBBO”) as of the time the ETF calculates current NAV per share. NAVs are calculated using prices as of 4:00 PM Eastern Time. The returns shown do not represent the returns you would receive if you traded shares at other times. Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the funds. Brokerage commissions will reduce returns.

Risk Information

Investing involves risk, including the possible loss of principal. Investments in smaller and mid-sized companies typically exhibit higher volatility. The funds are non-diversified. International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Frontier markets generally have less developed capital markets than traditional emerging market countries, and, consequently, the risks of investing in foreign securities are magnified in such countries. These countries are subject to potentially significant political, social and economic instability, which could materially and adversely affect the companies in which the Fund may invest. The Fund invests in the securities of Internet Companies, including internet services companies and internet retailers, and is subject to risk that market or economic factors impacting technology companies and companies that rely heavily on technology advances could have a major effect on the value of the Fund’s investments.